The Fair Labor Standards Act is a federal law that requires all covered, nonexempt employees be paid at least the minimum wage for all hours worked. A work week, which can begin on any day of the week, is 7 consecutive 24-hour periods or 168 consecutive hours. The regular rate of pay, however, is not always the same as the employee's hourly rate of pay. This is because all work-related payments must be taken into account when calculating an employee's correct regular rate of pay.

As a result, an employee's "regular rate" is always equal to or greater than his or her hourly rate of pay. There are various types of payments that employers are required to include when computing the regular rate of pay for all employees, both hourly and salaried. Wage theft can violate provisions of the Fair Labor Standards Act , which requires a federal minimum wage and requires employers to provide for overtime pay for people working over 40 hours per week.

How To Figure Out My Hours Worked When employers fail to meet these requirements, employees may be owed wages. Even when employers withhold amounts that seem small, the stolen wages can add up. For example, if a worker earns a wage of $290 for a 40-hour week, withholding a half hour a day from the paycheck translates into a loss of more than $1,400 a year . That could be almost 10 percent of a minimum-wage employee's annual earnings. I own a company that provides 40 hours of PTO to our employees every year on their anniversary date. My employees use their accrued PTO for vacation days, absences due to illness, personal time, doctor appointments, personal appointments, etc.

One of our employees used his 40 hours of PTO earlier in the year and he now wants to use eight hours of PTO for an absence on Thursday that he claims was due to illness. He says we owe him 40 hours of sick time because the time he used was for vacation. Do we have to grant paid leave for this absence and other absences during his anniversary year? Wage theft is the illegal underpayment or non-payment of wages owed to workers. Evidence from surveys suggests that wage theft is common and costs workers billions of dollars a year. This transfer of money from low-income employees to business owners is unfair and worsens income inequality while harming workers and their families.

Wage theft most often occurs with low-income workers and undocumented immigrant workers. A study found that 26% of low-wage workers were paid less than the minimum wage and found that 76% of workers who worked more than 40 hours were not paid the legally required overtime rate. From this study, it was estimated that workers lose an average of $2,634 annually due to these wage violations. In 2014, the director of the federal Labor Department's Wage and Hour Division stated that his agency had uncovered nearly $1 billion in illegally unpaid wages since 2010. He also noted that the victimized workers had been disproportionately immigrants.

Overtime hours means the time an employee works more than 40 hours per work week. Overtime pay is the special premium rate of compensation that employers must pay their employees for working overtime hours. Under federal and state law, overtime pay must equal at least one and one-half times an employee's regular rate of pay. So, if an employee regularly makes $10/hour, that employee is entitled to make $15/hour for all the overtime hours he or she works. Eligible workers who work more than 40 hours in one week must be paid one and one-half times their regular pay for every hour worked in excess of forty hours under the overtime pay requirements of Fair Labor Standards Act .

Not receiving adequate compensation for extra work is an issue experienced by many workers, particularly by lower-income workers. A 2019 study found that 13% of workers were not paid for hours worked outside of their usual schedule. When this group was broken down by income, the highest percentage of respondents were in the $15,000 to $19,999 bracket. When broken down by gender, 16% of women were not paid for their overtime work, while 9% of men were not paid for their overtime work.

For more information about whether you are eligible for overtime pay, please see our site's overtime page. If both state and federal overtime laws apply, the employee is entitled to whichever overtime protection is most strict and provides the most protection to you as an employee. An eligible "employee" is an individual who renders personal services at a fixed rate to an employer.

An employer is only required to track and report the first 40 hours of PTO in a situation described above. Once those first 40 hours have been used, regardless of whether the employee used that time for sick time, there is no further requirement to track the PTO hours. It may still be beneficial to track time used after 40 hours however. Family leave laws allow eligible employees to use any accrued paid sick leave, vacation leave or any leave given in lieu of vacation leave (i.e., PTO) during family leave.

Employers who have employees with disabilities may also want to track this time for purposes of determining when absences attributable to a disability become an undue hardship. Many states have laws that require employers to pay employees for all hours worked, and which require employers to pay employees at regular intervals, such as biweekly or semimonthly. These laws may impose penalties on employers who do not comply with the law, and may even provide for criminal prosecution. My employer has a combined paid time off policy that I can use for vacation, personal time, and illness. Your employer is not obligated to give you additional leave for paid or unpaid sick time if they meet the legal minimums for sick time through their combined PTO policy.

That PTO policy must be the same as or more generous than state laws require. In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours.

That might be just additional money, time off adequate to the number of overtime hours, or other benefits. When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. There are a few jobs which are exceptions from that rule . To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law. This article reviewed a lot of options for tracking employee time. Department of Labor does not enforce how employers track employee hours, it does provide guidelines to track employee hours accurately.

Regulations that state how long an employer must retrain payroll related data. Currently, employers are required to retain timecards and payroll related calculations for at least two years during and after employment. A complete list of wage-related information is located on the Department of Labor website dol.gov. The FLSA is enforced by the Wage-Hour Division of the U.S. Where violations are found, they also may recommend changes in employment practices to bring an employer into compliance. The Department of Labor is authorized to supervise the payment of unpaid minimum wages and/or unpaid overtime compensation that is owed to any employee.

Department of Labor's Wage and Hour Division, and include information regarding your job title, pay, hours, and additional information from pay stubs and other payment information. You can also pursue your case at a state level, with state labor and employment division resources. You may also choose to pursue a private cause of action against your employer. In some states, employees are allowed to file wage theft claims in small claims court as long as the amount in question does not exceed the jurisdictional limit.

I operate a manufacturing facility and we have a collective bargaining agreement with our workers. I see that there is a CBA exemption in the law, so are we exempt from the sick time law? My business has a PTO policy that I believe is substantially equivalent to the new sick time law.

Do I have to separately track the reasons for taking PTO based on whether the employee is taking it for vacation, for illness, or for some other reasons? Essentially, your employee's PTO bank of 40 hours could have been available for sick time but for the fact that the employee chose to use it for vacation or a combination of other reasons. Except for delayed implementation of new minimum wage rates, the Minimum Wage Act makes no distinction between full-time, part-time and temporary employees. Some employers who provide benefits to full time workers may not provide the same benefits to their part-time or temporary employees.

If you are not a full-time employee and you want to know if you are entitled to benefits, you will need to discuss this with your employer. An employer should have set guidelines to establish who qualifies for benefits and who does not. For information on delayed implementation of the new minimum wage rates for smaller employers, you should click here for complete details on Pennsylvania's new minimum wage requirements. There are certain types of payments that an employer may exclude under the FLSA when computing an employee's regular rate of pay. For example, gifts, discretionary bonuses, profit-sharing plans, thrift-saving plans, and pension benefit plans may be excluded from computing an employee's regular rate of pay.

Also, employers may exclude all "premium" payments if the payment equals or exceeds one-and-one half times the employee's pay rate for the hours worked during that time period. The time clock is a simple system that captures the in/out times of your staff members when they arrive, take an unpaid break or leave at the end of their shift. If staff forget to clock in/out, changes can only be made via the "Timesheets" page. The "Timesheets" page is fed by the hours captured by the time clock, the scheduled hours from your staff rota, and submissions from your staff. After the shift times on the "Timesheets" page are approved by a timesheet manager, they will begin to appear in your reports, ready for you to generate your payroll. What happens if an employee takes a day of sick time before any is accrued?

If a new employee takes sick time before any leave has been accrued or before the 91st day of employment, the sick time is not protected under the sick time law and is subject to the employer's regular attendance policies. Also, since the employee had not accrued any sick time yet, the time off does not count against the employee's right to earn and use up to 40 hours of protected sick time for that year. Remember, though, even if sick time is not protected under this law, it may be protected under applicable OFLA, FMLA, or ADAA regulations. We provide our employees with 40 hours of PTO each year that may be used for vacation or sick leave. My employee does not want to be paid when he is out sick because he wants to save the time for vacation.

Do I have to require the employee to take the day as paid sick time? Best practice would be to require the employee to take the day as paid sick time. But, the law does not mandate that you require employees to take paid sick time. I see sick time protections change if I have 10 or more employees. What if I have 11 employees, but only for a short period of time as seasonal workers?

All employees employed by the employer (full-time, part-time, seasonal, and temporary) must be counted for purposes of determining the number of employees. An employee's workweek is a fixed and regularly recurring period of 168 hours — seven consecutive 24-hour periods. It need not coincide with the calendar week, but may begin on any day and at any hour of the day. Different workweeks may be established for different employees or groups of employees. Averaging of hours over two or more weeks is not permitted. Normally, overtime pay earned in a particular workweek must be paid on the regular pay day for the pay period in which the wages were earned.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below.

Hours actually worked means hours spent directly on work and excludes things like annual leave, sick leave, public holidays, meal breaks, and commuting time. Unpaid family work in this case generally includes market-oriented work, such as for the family business, but not other unpaid work at home such as childcare, cooking, and cleaning. Since the latter type of unpaid work is typically performed by women, this has large implications for understanding gender differences in labor. We discuss these issues as part of our entry on Women's Employment. File for unemployment in the first week that you lose your job or have your hours reduced. Your claim begins the Sunday of the week you applied for unemployment.

You must serve a one-week unpaid waiting period on your claim before you are paid UI benefits. The waiting period can only be served if you certify for benefits and meet all eligibility requirements for that week. Your first certification will usually include the one-week unpaid waiting period and one week of payment if you meet eligibility requirements for both weeks. Certify for benefits every two weeks to continue receiving benefit payments.

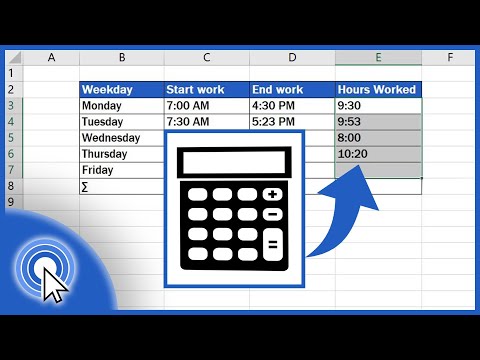

For this to be helpful, you'll need to decide what your pay period is. Or you can determine your hourly rate for a shorter period of time, such as a month or a few weeks. OT Overtime The Time Card summary shows regular work hours and overtime hours. How you calculate the employee's gross wages depends on if they are hourly or salaried. For hourly workers, multiply the employee's hourly pay rate by the number of hours worked in the pay period.

To find a salaried worker's gross pay, divide their annual salary by the number of pay periods in the year. If you were not paid at least the minimum wage or you were not paid correctly for your overtime hours, you should try to file a wage claim within two years from the date the work was actually performed. Since your employer is only required to keep its records for three years, it is more difficult for the Department of Labor & Industry to collect your wages as time passes.

There is no Pennsylvania labor law which requires an employer to pay an employee not to work. Benefits like sick leave, vacation pay and severance pay are payments to an employee not to be at work. Therefore, an employer only has to pay these benefits if the employer has a policy to pay such benefits or a contract with you to pay these benefits. An employer must follow its own rules for these kinds of payments.

There may also be federal requirements governing leave that has to be provided under the Americans with Disabilities Act and Family Medical Leave Act. There may be additional requirements for certain persons within the City of Philadelphia. You can find information on the City of Philadelphia city government website. The Pennsylvania Department of Labor & Industry does not enforce city ordinances. Federal banking law requires that anyone who writes a check, including employers, must have enough funds in the bank to cover the check. Additionally, many states have laws requiring that an employer is able to cover paychecks for a certain length of time after they are issued.

Under certain conditions, severance, vacation, holiday or sick pay may be allocated to a period of time in which UI benefits are claimed. You are not eligible to receive benefits for any week in which allocated severance, vacation, holiday or sick pay exceeds your weekly benefit amount. If the payments are less than your weekly benefit amount, they will be deducted as earnings.

You must report severance, vacation, holiday or sick pay when you file your initial application for benefits. If you receive any such payments after you file your initial application, you should immediately contact the AZ Unemployment Insurance Call Center. What if an employee accrues more than 40 hours of sick time over the course of a year?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.